UK non-resident landlord companies: are you successfully navigating the UK Corporation Tax regime?

It is now a few years since offshore companies registered as UK non-resident landlords (NRLs) were brought into the scope of UK Corporation Tax (CT) in respect of UK rental profits. With the recent increase in the main rate of UK Corporation Tax to 25% from 1 April 2023, Alex Birch, Senior Manager from Equiom Tax Services Limited, explores some of the common pitfalls and mistakes that he and the team have seen over recent years.

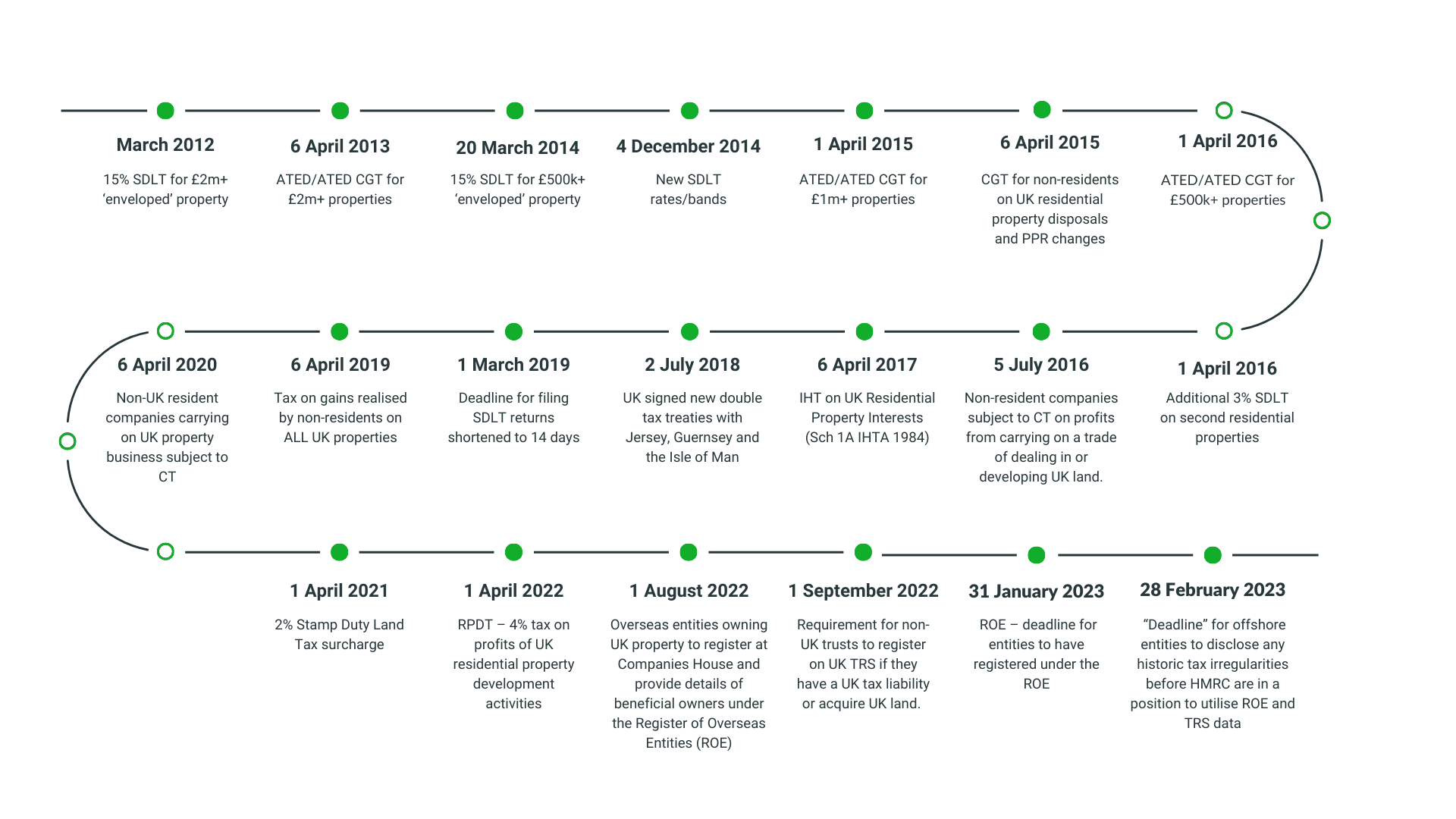

Over the past decade, the UK Government has increased the scope of taxation on UK property which is held by non-UK residents (with UK resident individuals and companies already being subject to UK tax on their income and gains). The following timeline shows the extent of the changes and how fast they have been implemented:

NRL companies subject to UK Corporation Tax will have noticed differences in terms of both tax technical treatments and administration, compared to the Income Tax regime they were previously subject to. The Equiom Tax Services team have seen a number of regular mistakes made in the returns of NRL companies adapting to the Corporation Tax regime, the following list is some of the more common ones Alex has noted:

Common pitfalls and mistakes in NRL CT returns

Property disposals information – there are multiple gain calculation methods, which differ depending on the type of property being disposed of. Companies should ensure that they have the relevant information available should they dispose of any UK land or property. Some of this information (e.g. cost, incidental costs of acquisition) may be historic depending on the length of ownership but can provide valuable deductions in the gain calculation.

Payment deadline(s) – companies need to ensure they check (and then monitor) their CT payment position. This is especially important for companies within groups, in case they may be caught by the Quarterly Instalment Payment (QIP) regime with the first QIP being payable during the accounting period in question. A company falls into the QIP regime if it is deemed to be ‘large’ or ‘very large’ for Corporation Tax purposes. In order to be classed as such it needs to breach certain profit limits which are split between the relevant number of 51% related group companies (hence the larger the group, the easier to be deemed ‘large’). Management budgets/forecasts should be used to determine whether companies should make QIPs in respect of their current accounting period, in order to avoid any late payment interest as it is too late to assess the position after the accounting period has ended.

Interest accruing but not being paid – interest must be paid within 12 months of the company’s year end in order to be deducted for CT purposes. The team have seen a number of entities simply accruing related party interest without making payment, leading to increased tax liabilities compared to those previously expected.

Property related ‘capital’ trigger events – companies need to be aware of less obvious capital events related to their UK property that are treated as chargeable gains or should be treated as part disposals of the relevant UK property for UK tax purposes. A couple of examples of capital events are:

- The receipt of lease premiums or lease surrender premiums

- Receiving proceeds from option agreements (to sell a UK property)

This is of course not an exhaustive list, and any such items should be considered carefully in terms of the CT treatment and should not just be included within the rental profit calculation.

Options to sell UK property lapsing – options to sell UK land and/or property should be carefully monitored and if such an option lapses it will be taxable as if it were a ‘disposal’ of UK land and/or property and will therefore be taxable on non-resident recipients.

Capital allowances:

- Companies should always consider the type of property capital expenditure relates to before considering eligibility for capital allowances – there is a big difference between the capital allowances available relating to commercial properties compared to residential properties.

- When purchasing a UK commercial property, companies should always consider whether there may be any capital allowances available to transfer over from the seller. If so, an election should be put in place and agreed with the seller to transfer the relevant capital allowance pools to the buyer. As part of any due diligence undertaken on property purchases, we would recommend investigating what (if any) capital allowances may have previously been claimed on a building by the seller. There could also potentially be a significant amount of capital allowance eligible assets within the building which might not have been claimed already (meaning the buyer can claim them providing the assets are still within the building).

Deductions allowance – if any UK CT losses brought forward are utilised then a company needs to consider the deductions allowance and must submit a Group Allocation Allowance Statement, which must be submitted even for standalone companies.

Base cost of UK property/properties – companies should ensure that they track the base cost of their UK property, especially when any part disposals are deemed to have happened which might utilise some of the base cost against a potential gain (e.g. if a lease premium is received or a receipt of a payment in respect of a buildings ‘right to light’).

Consideration of tax treatment of debt in company closures – When closing a company, many consider the tax implications regarding disposing/distributing the assets of the company, but the team have seen that the debt is often not considered in full. The tax treatment of either relocating the debt (maybe elsewhere in the group) or writing off the debt needs to be considered carefully as such actions could have severe tax implications if not undertaken properly.

How Equiom Tax Services Limited (ETSL) can help you with your Corporation Tax needs:

ETSL offers extensive UK Corporation Tax services, from full corporate tax compliance services to technical advice covering all areas, such as:

- Group reorganisations

- Transactions advice

- Closure of structures

- De-enveloping

- Corporate Interest Restriction

- Disregard regulations

- Group relief claims and group tax efficiency

- Capital Gains Tax exemption elections

If you need assistance with any of the above areas or would like a quote for any Corporation Tax related work, please contact our tax team.