DFSA May 2025 reforms explained: Key takeaways from Consultation Paper 161 on Prudential Regulation

The Dubai Financial Services Authority (DFSA) has introduced extensive changes to its prudential regulation framework through legislative amendments adopted in May 2025, following Consultation Paper No. 161. These reforms reflect a major shift in how financial firms in the DIFC are supervised, particularly through a more tailored and proportional regulatory model.

The changes affect the PIB, FER, GLO, AUD, and COB Modules of the DFSA Rulebook and are being implemented in two phases:

- Phase 1: Effective 1 July 2025

- Phase 2: Effective 1 July 2026

For many Category 3 and 4 firms, this translates into lower capital burdens, more flexible liquidity management, and clearer classifications which aligns compliance requirements more closely with the true risk profile of firms. Roy Reaidi, Governance, Risk and Compliance Advisor and Ambreen Manzoor, Senior Manager, Governance, Risk and Compliance at Equiom, outline the main changes and how your business can prepare.

Why is the DFSA making these changes?

The DFSA recognises that the previous prudential framework applied similar capital and liquidity requirements across a diverse population of firms, irrespective of their scale and risk. This resulted in smaller or low-risk firms shouldering regulatory burdens similar to large, systemically important entities. Through Consultation Paper CP161, the DFSA proposed a more proportionate approach, improving fairness in capital and liquidity regulations, flexibility in asset classification for liquidity purposes, clarity in regulatory categories and greater alignment with international standards (drawing from Basel and EU models).

What changes take effect on 1 July 2025?

1. Expenditure Based Capital Minimum (EBCM) Removed for Non-Asset-Holding Firms

Firms in Category 3A and 3C that do not hold Client Assets, Insurance Monies, or Fund Property are no longer subject to EBCM as these firms are considered to pose limited harm to clients during wind-down due to absence of asset custody. This includes:

- Category 3A: Agents dealing in investments without holding assets

- Category 3C: Asset Managers and Advisory Firms with no custody

2. New Liquidity Requirement Introduced

All Category 3 and 4 firms that are no longer subject to EBCM must maintain liquid assets equal to or greater than their Base Capital Requirement (BCR).

3. Wider Range of Eligible Liquid Assets

To meet liquidity requirements, the following can now be used:

- At least one third in cash, bank deposits, or settlement receivables

- Up to two thirds high-quality liquid bonds denominated in USD, AED, GBP, or EUR, with maturities under 12 months, rated A or above, and issued by sovereigns, MDBs, or PSEs

4. EBCM Calculation Formula Reduced

For firms that still hold assets (e.g., Trustees, Custodians, Fund Managers) EBCM has been reduced to 13/52 of Annual Audited Expenditure (down from 18/52).

5. Exclusion of Depreciation and Amortisation in EBCM

EBCM must now exclude non-cash expenses, making it a more accurate representation of actual outflows.

6. Reclassification of Certain Firms

- Matched Principal Firms: Move from Category 3A to Category 2. No change in prudential treatment, only categorisation clarified.

- ATS Operators: Move from Category 4 to Category 3A, with a revised BCR of USD 200,000.

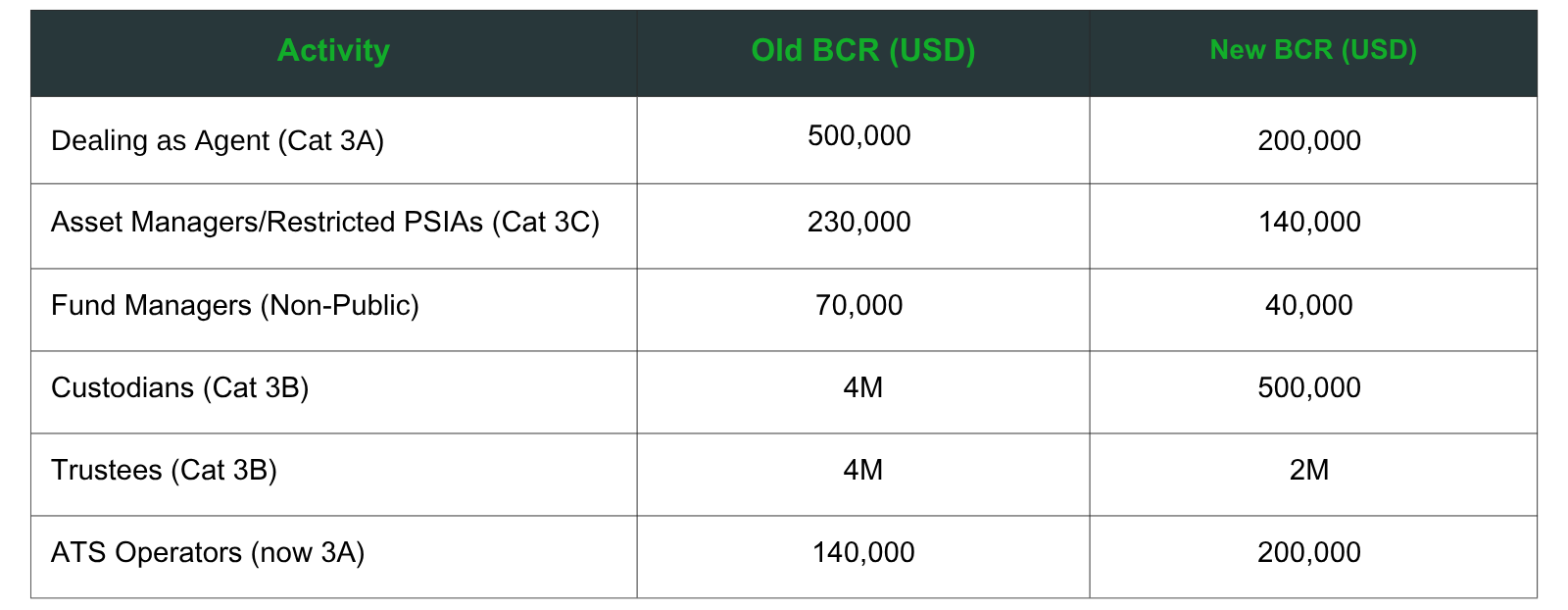

7. Base Capital Requirement (BCR) Adjustments

What Changes Take Effect on 1 July 2026?

1. Activity-Based Capital Requirement (ABCR)

ABCR introduces capital requirements that scale with a firm’s activity.

- K-AUM (Assets under Management): 0.02% of value

- K-ASA (Assets Safeguarded and Administered): 0.06% of value

- K-COH (Client Orders Handled):

- 0.1% of cash equity trades

- 0.01% of derivatives trades

Firms must hold the greater of ABCR, EBCM (if applicable), or BCR.

2. Minimum Capital Composition Standards

To ensure resilience, the capital held must meet these quality thresholds:

- 60% of requirement must be CET1 Capital

- 80% must be Tier 1 Capital (including CET1)

- Only 20% can be Tier 2

3. Revised Professional Indemnity Insurance (PII) Requirements

Most Category 3 or 4 firms are no longer obligated to maintain PII, except where they serve retail clients, operate as Employee Money Purchase Scheme (EMPS) firms, or act as insurance intermediaries or managers. Where PII is still required, the minimum coverage is set at USD 1 million generally, or USD 800,000 for insurance intermediaries. Additionally, the retroactive cover period has been reduced from six years to four.

4. Auditor Review Expansion

Registered Auditors must now verify capital requirement calculations for EBCM (where applicable), ABCR (for Category 3 firms) and Transaction or Stored Value capital requirements (for Category 3D firms)

How should companies navigate these regulatory changes?

With the first phase of reforms now in effect and further changes set for July 2026, firms should take a proactive, structured approach to implementation. Rather than viewing each change in isolation, consider how the reforms interact and what they collectively signal about the DFSA’s evolving supervisory priorities and take the following steps to prepare and adapt:

- Understand Your Timeline: Identify which changes apply to your firm now (e.g., EBCM removal, new liquidity rules, BCR adjustments) and which will apply later (e.g., ABCR, revised PII requirements).

- Review Capital and Liquidity Requirements: Ensure compliance with the updated BCR and liquidity rules already in effect. For firms still subject to EBCM, apply the revised calculation method.

- Plan for ABCR: If your firm will be subject to the Activity-Based Capital Requirement from July 2026, begin modeling your exposure to K-factors like K-AUM and K-COH now.

- Update Internal Systems: Adjust reporting, compliance, and treasury systems to reflect the new capital and liquidity standards.

- Engage with Auditors and Strengthen Internal Oversight: Coordinate with your auditors to ensure readiness for expanded capital reviews, and use this period to enhance internal processes, documentation, and controls in line with the new requirements.

- Reassess PII Coverage: Determine whether your firm still requires Professional Indemnity Insurance under the new rules and adjust policies accordingly.

Our team includes experienced Finance Officers, supported by a broader network of Compliance, Risk, and Governance professionals. Together, they specialise in navigating prudential requirements and financial oversight to ensure your business remains compliant. If you’re unsure how these changes affect your business or would like to reassess your capital strategy under the new rules, Equiom is well-positioned to support you.

This article has been carefully prepared, but it has been written in general terms and should be seen as broad guidance only. This article cannot be relied upon to cover specific situations, and you should not act, or refrain from acting, upon the information contained within this article without obtaining specific professional advice. Please contact Equiom to discuss these matters in the context of your particular circumstance. Equiom Group, its partners, employees, and agents do not accept or assume any liability or duty of care for any loss arising from any action taken or not taken by anyone in reliance on the information in this article or for any decision based on it.

FSRA Consultation Paper No. 1 of 2025 – Proposal for Periodic Fund Reporting Requirements in ADGM

FSRA’s Consultation Paper no. 2 of 2025: Review of prudential framework for lower-risk firms

Understanding the ADGM Cyber Risk Framework: Insights from Consultation Paper 3 of 2025

Get in touch

If you have any questions, or would like to learn more about taking the next steps with Equiom, please select one of the options below.

Choose a location and contact the team Use our website form