Crowdfunding in the DIFC: Navigating DFSA License Requirements with Corporate Governance Consulting

The Dubai International Financial Centre (DIFC) has positioned itself as a leading financial hub in the Middle East, providing a robust regulatory environment for innovative financial services, including crowdfunding. With clear guidelines set by the Dubai Financial Services Authority (DFSA), crowdfunding platforms in the DIFC benefit from a structured and transparent framework that fosters trust and compliance. Many businesses seek corporate governance consulting service providers to navigate these requirements and obtain a DFSA license.

Understanding Crowdfunding

Crowdfunding is the practice of raising capital from a large number of investors via an online platform. These platforms facilitate connections between individuals or entities seeking funding and those willing to provide it. The DFSA recognises three main types of crowdfunding platforms:

- Loan Crowdfunding Platforms – These platforms allow lenders to provide capital to borrowers for business ventures or projects. The platform operator manages loan agreements, repayments, and any associated rights enforcement.

- Investment Crowdfunding Platforms – Investors fund businesses or projects (excluding property transactions) in exchange for equity. The platform operator administers the investment process, including payment management and the exercise of investor rights.

- Property Investment Crowdfunding Platforms – Investors participate in property investments, with assets typically held through a Special Purpose Vehicle (SPV). The platform operator connects investors with property sellers, oversees the investment, and manages associated services, ensuring adherence to DFSA license regulations.

All crowdfunding platforms in the DIFC must operate electronically, ensuring seamless administration of transactions, investments, loans, and property dealings in accordance with DFSA license standards.

Crowdfunding Regulatory Requirements in the DIFC

Crowdfunding in the DIFC is governed by regulations designed to enhance transparency, protect investors, and uphold the integrity of the financial system. Key requirements include:

- Adherence to DFSA Rules – There are clear guidelines on platform conduct, disclosure, and transparency that must be followed; engaging a professional corporate governance service provider can help ensure compliance.

- Licensing – Platforms must obtain a DFSA license based on their crowdfunding model (loan, investment, or property investment). Corporate governance consulting service providers are often engaged to ensure every aspect of the application meets DFSA expectations.

- Investor Protection – Platforms must implement Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures, provide full risk disclosures, and comply with DFSA investor protection guidelines.

- Investor Eligibility – Investors are categorised as either retail or professional clients, with varying levels of access and restrictions depending on the crowdfunding type.

- Capital Requirements – Crowdfunding platforms must maintain adequate capital to support their operations. The base capital requirement for all crowdfunding platforms in the DIFC is set at USD 140,000.

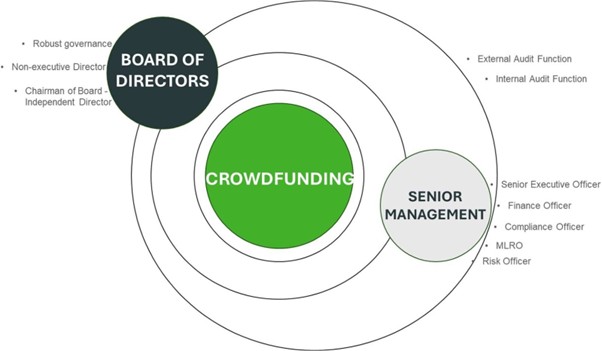

Governance Structure for Crowdfunding Platforms

Strong governance is critical for the successful operation of crowdfunding platforms in the DIFC. Platform operators must ensure they adhere to regulatory expectations and maintain effective risk management practices.

Partnering with providers of corporate governance consulting services can help maintain high standards and secure the necessary DFSA license for operations.

How Equiom can support clients with corporate governance consulting services.

Equiom provides a comprehensive range of services to support businesses in establishing and managing crowdfunding platforms within the DIFC. Our expertise includes:

- Licensing Assistance – Navigating the DFSA license process to ensure compliance with all regulatory requirements.

- Independent Non-Executive Director (NED) Services – Providing experienced NEDs to enhance board governance in line with DIFC standards.

- Regulatory Compliance – Offering outsourced compliance services, including KYC/AML implementation, and advising on ongoing DFSA compliance. Equiom can also provide outsourced Money Laundering Reporting Officer (MLRO) services.

- Risk Officer Services – Assisting in risk identification and management through outsourced Risk Officer services to ensure secure platform operations.

- Finance Officer Services – Managing financial operations, including accounting and financial reporting, to ensure compliance with DFSA financial requirements.

With its deep understanding of the DIFC regulatory landscape, Equiom is well-positioned to provide businesses with top-tier corporate governance consulting services that help them navigate the complexities of crowdfunding regulations, secure a DFSA license, and establish successful, compliant platforms.

For expert guidance on launching a crowdfunding platform in the DIFC, securing your DFSA license, or accessing trusted corporate governance consulting services, contact our team today.

This article has been carefully prepared, but it has been written in general terms and should be seen as broad guidance only. This article cannot be relied upon to cover specific situations, and you should not act, or refrain from acting, upon the information contained within this article without obtaining specific professional advice. Please contact Equiom to discuss these matters in the context of your particular circumstance. Equiom Group, its partners, employees, and agents do not accept or assume any liability or duty of care for any loss arising from any action taken or not taken by anyone in reliance on the information in this article or for any decision based on it.

Get in touch

If you have any questions, or would like to learn more about taking the next steps with Equiom, please select one of the options below.

Choose a location and contact the team Use our website form