Client Classification in DIFC and ADGM: Understanding Your Financial Rights and Protections

If you are a business or an individual using financial services in the Dubai International Financial Centre (DIFC) or Abu Dhabi Global Market (ADGM), it is important to understand how you are classified as a client. Your classification – whether as a Retail Client, Professional Client or Market Counterparty - determines your financial rights, regulatory protections, and disclosure requirements to the regulator.

It also affects the type and complexity of financial products and services that can be offered to you, as well as the regulatory obligations imposed on the financial institution serving you.

Two main regulators oversee these financial hubs:

- The Dubai Financial Services Authority (DFSA) which governs DIFC

- The Financial Services Regulatory Authority (FSRA) which governs ADGM

Both the DIFC and ADGM regulators classify clients based on their financial knowledge, experience, and available resources. This guide clearly explains the classification process, helping you understand how it applies to you or your business and the corresponding rights and obligations under the regulatory frameworks.

Why client classification in DIFC and ADGM matters

Understanding your classification is essential because it directly determines the level of protection, regulatory oversight and services you receive. Retail clients benefit from the highest level of regulatory protection including enhanced disclosure, suitability assessments, and access to formal complaint mechanisms. Professional clients in DIFC & ADGM have more access and flexibility but receive fewer regulatory protections as they are considered financially more sophisticated. Market counterparties, on the other hand, operate at an institutional level with minimal regulatory protection due to their assumed expertise and resources.

For both businesses and individuals, knowing how you are classified helps you make informed financial decisions and ensures you remain compliant with the relevant regulations.

Client classification in DIFC (DFSA)

The Dubai Financial Services Authority (DFSA) classifies clients into three main categories, each receiving different levels of regulatory protection based on their financial knowledge, experience, and resources:

- Retail clients are typically individuals or small businesses with limited financial experience. They receive the highest level of protection from regulators, including full disclosures, suitability assessments, and access to dispute resolution services.

- Professional clients have a greater level of financial knowledge and experience. They receive less regulatory protection but have more flexibility in their financial transactions. Professional clients fall into three sub-groups:

- Large institutions, which include governments, banks, and investment firms.

- Business clients, which are companies using financial services for commercial activities.

- High-Net-Worth Individuals, defined as those with at least USD 1 million in net assets (excluding their primary residence) and who possess relevant financial expertise or qualifications

Professional clients must sign a declaration acknowledging and accepting the risks associated with their classification.

- Market counterparties are large, sophisticated financial institutions that trade with one another. They receive the least regulatory protection, based on the assumption that they fully understand the risks involved in complex financial transactions.

How are clients classified in DIFC?

To qualify as a Professional client, an individual must own at least USD 1 million in net assets (excluding their primary residence), show experience in financial markets (e.g. investment history, professional qualifications), and sign a document confirming they understand and accept the risks of this classification.

For businesses to qualify as a Professional Client, classification is based on financial standing and the nature of the services they require. Larger businesses often qualify automatically if they meet specific financial thresholds.

For joint accounts, the primary account holder must qualify as a Professional client, while the other account holders ( e.g. family members) must agree in writing to the classification.

Client classification in ADGM (FSRA)

Retail clients are individuals or small entities with limited financial knowledge and experience. They receive the highest level of regulatory protection, including enhanced disclosure, suitability assessments, and access to formal complaint mechanisms.

Professional clients in ADGM include large institutions, businesses that meet certain financial thresholds, and High-Net-Worth Individuals, who are individuals with at least USD 1 million in assets, and proven financial experience and professional certifications.

Market Counterparties are large, sophisticated financial firms that trade with one another and receive fewer regulatory protections. They receive the least regulatory protection, based on the assumption that they fully understand the risks involved in complex financial transactions.

How are clients classified in ADGM?

The classification process in ADGM is similar to DIFC. To qualify as a Professional client, individuals must own at least USD 1 million in net assets (excluding their primary residence), have relevant experience in financial markets (e.g. trading history, professional certifications), and sign a document acknowledging and accepting their classification.

For businesses to qualify as a Professional Client, classification is based on financial size and expertise. Some companies qualify automatically if they meet the regulator’s financial criteria.

For joint accounts, all account holders must agree in writing to be treated as Professional clients.

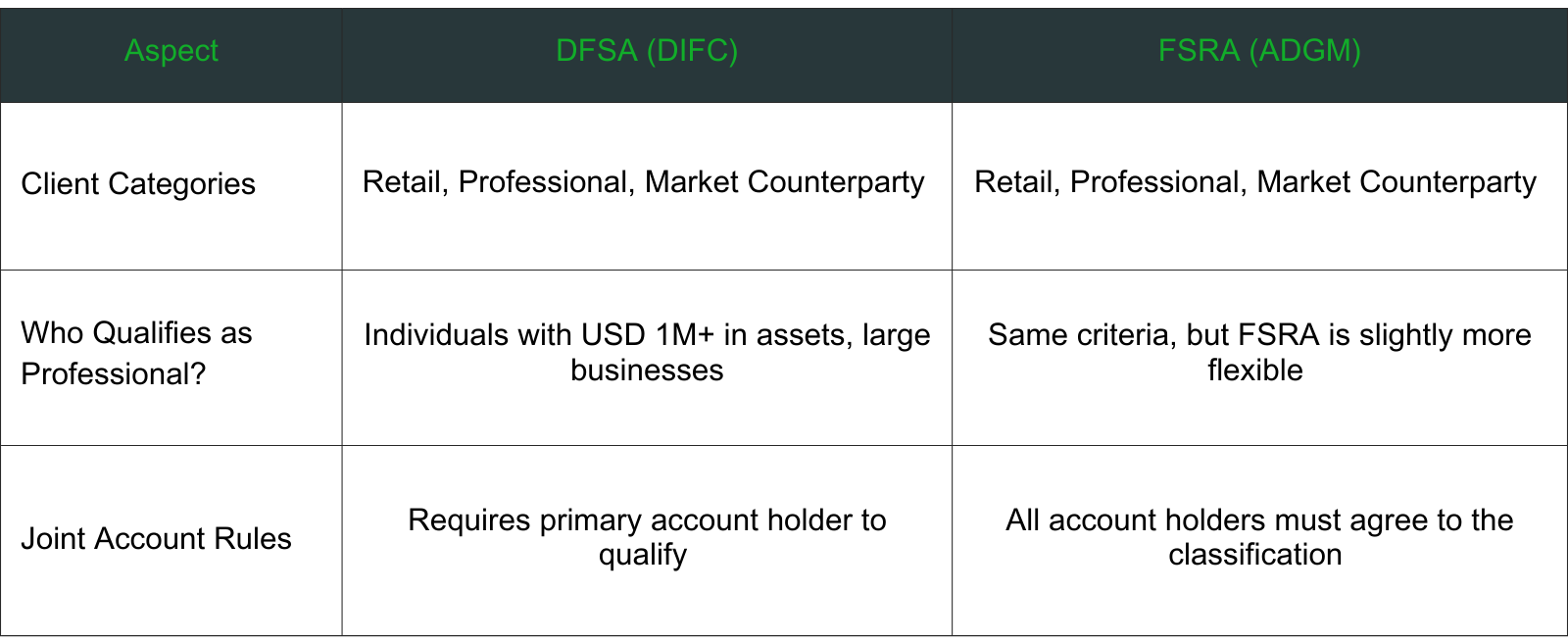

Key Differences Between DFSA and FSRA in Client Classification

How Outsourced Compliance Officer & MLRO services can help

Ensuring that you are correctly classified can help you access the financial services best suited to your needs while ensuring compliance with regulatory requirements. Whether you are an individual investor or a business, accurate classification is key to making informed financial decisions and helps you meet compliance obligations.

Our expert team of Outsourced Compliance Officer & MLRO is here to help you navigate this process with ease. From ensuring proper client onboarding in DIFC & ADGM to advising on regulatory requirements, we support businesses and individuals in meeting compliance obligations efficiently.

Get in touch with our Governance Support & Solutions experts today to discuss your classification status and ensure you are fully compliant with DIFC and ADGM regulations. Our teams in the Middle East specialise in compliance services for DIFC & ADGM, ensuring a smooth and fully compliant setup. Whether you need assistance with Professional clients in DIFC & ADGM or broader compliance needs, we provide expert guidance at every step.

This article has been carefully prepared, but it has been written in general terms and should be seen as broad guidance only. This article cannot be relied upon to cover specific situations, and you should not act, or refrain from acting, upon the information contained within this article without obtaining specific professional advice. Please contact Equiom to discuss these matters in the context of your particular circumstance. Equiom Group, its partners, employees, and agents do not accept or assume any liability or duty of care for any loss arising from any action taken or not taken by anyone in reliance on the information in this article or for any decision based on it.

Get in touch

If you have any questions, or would like to learn more about taking the next steps with Equiom, please select one of the options below.

Choose a location and contact the team Use our website form