Rethinking End of Service Benefits in the UAE: DEWS and the shift beyond traditional gratuity

Introduced in February 2020, the DIFC Employee Workplace Savings (DEWS) Plan is a modern, funded End of Service savings scheme implemented within the DIFC to replace the traditional gratuity model, which remains mandated elsewhere in the UAE.

DEWS has also been adopted by the Dubai Government to manage end of service benefits for their employees. Since launch, DEWS, which applies to employers with eligible employees operating within the DIFC and Dubai Government, has expanded to cover more than 50,000 employees and has recently surpassed USD 1 billion in Assets Under Administration.

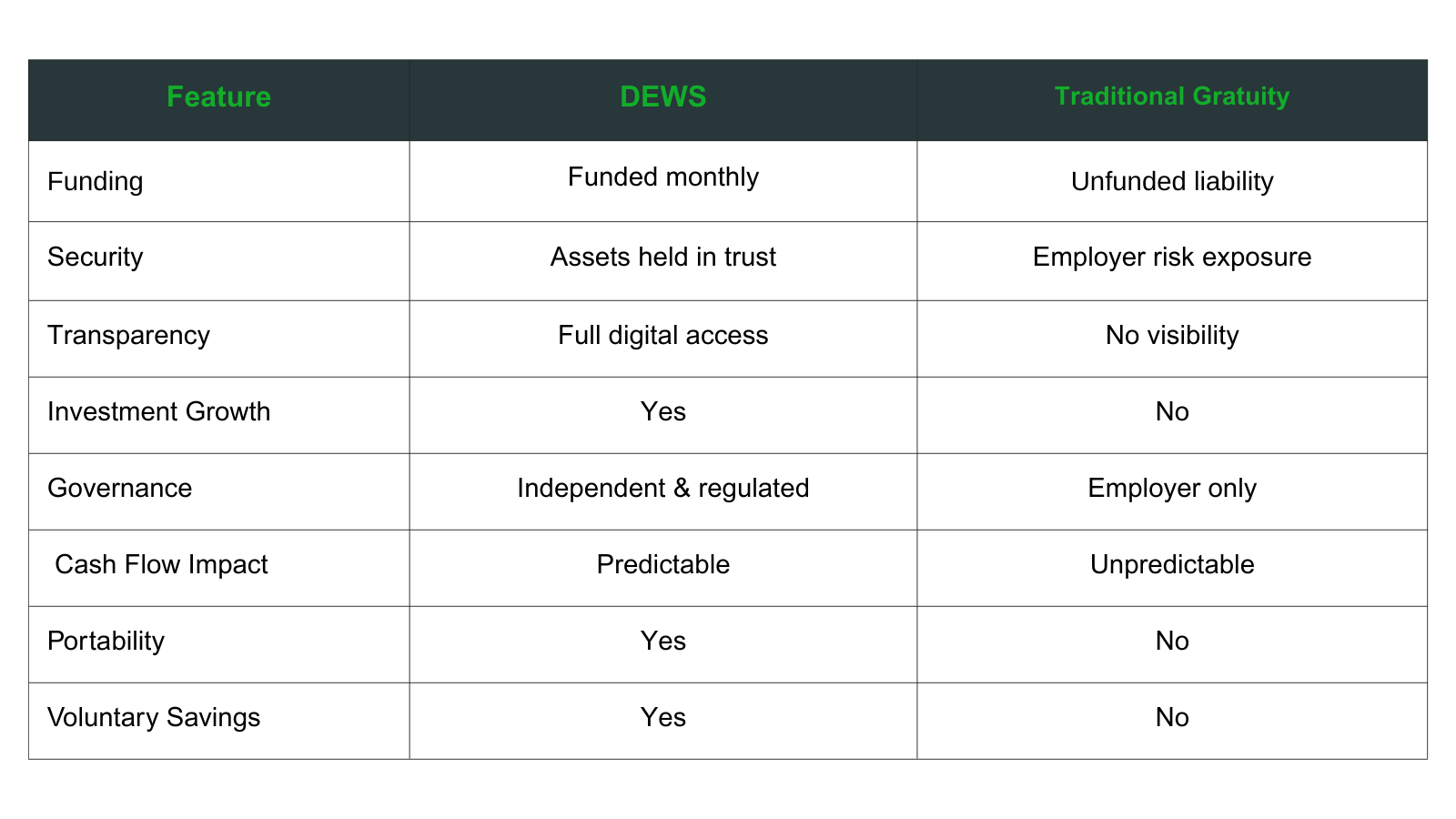

While both models continue to co-exist in the UAE, their underlying structures differ fundamentally. The comparison below highlights how DEWS represents a shift from a legacy End of Service obligation to a professionally governed, forward looking savings framework for employers and employees alike.

1. Funding & Financial Security

DEWS (Funded Savings Model)

- Employer pays monthly contributions into a DIFC trust. Key providers are regulated by the DFSA and DEWS is approved by the DFSA as an Employee Money Purchase Scheme.

- Funds are ring fenced and held separately from employer assets.

- Employee benefits remain protected even if the employer faces financial difficulty.

- Removes large End of Service payout shocks for employers.

Traditional Gratuity (Unfunded Liability)

- Employer pays gratuity only at the end of service.

- Liability is typically unfunded and sits on the employer’s balance sheet.

- Can create cashflow pressure if multiple employees leave simultaneously.

- If an employer becomes insolvent, employees end of service is at risk.

Key consideration: DEWS provides a funded and predictable framework, offering greater security for employees and improved financial planning for employers.

2. Employee Control & Transparency

DEWS

- Employees have direct access to view account values, contributions and fund performance.

- Investment strategies can be actively managed by the employee.

- Voluntary contributions may be made to enhance personal savings.

Traditional Gratuity

- Limited visibility for employees until employment ends.

- No account value, statements or investment capability.

Key consideration: In practice, this means employees benefit from greater transparency and engagement with their long term savings.

3. Investment & Growth

DEWS

- Contributions are professionally invested.

- A range of investment strategies is available, including Sharia compliant options.

- Provides potential for short, medium & long term growth.

Traditional Gratuity

- In the majority of cases not investment linked and therefore generates no investment related growth.

- Real value may erode over time due to inflation.

Key consideration: Over the long term, DEWS offers the potential for materially higher value accumulation.

4. Governance & Protection

DEWS

- Independent trustee oversight.

- DIFC based providers regulated by the DFSA.

- Assets protected from employer misuse.

Traditional Gratuity

- No third-party governance.

- Entire liability rests with the employer.

Key consideration: From a governance perspective, DEWS introduces independent oversight and legal safeguards that do not exist under the traditional model.

5. Employer Impact

DEWS

- Predictable monthly expense.

- Reduced legal and financial risk.

- Supports talent attraction and retention.

Traditional Gratuity

- Unpredictable End of Service payout obligations.

- Liability accumulates over time.

Key consideration: For employers, DEWS represents a more modern and manageable approach to workforce liabilities.

6. Employee Mobility & Flexibility

DEWS

- Full value payable on termination.

- Benefits can stay invested in DEWS should an employee wish to defer withdrawal on exit of employment.

- Withdrawal payments may be made in multiple currencies and to bank accounts outside the UAE.

- Voluntary contributions permitted.

- Employees may nominate beneficiaries.

Traditional Gratuity

- Payable by employer on exit of employment.

- No opportunity to invest or make voluntary contributions

- May be reduced or forfeited depending on termination circumstances.

Key consideration: This flexibility aligns more closely with international employment and mobility expectations.

From End of Service Obligation to Workforce Savings Strategy

DEWS reflects a broader shift in how End of Service benefits are viewed in a modern employment environment. Employers have adopted DEWS to fund pre-February 2020 funded and unfunded liabilities, improve financial predictability and align with modern governance standards.

Rather than remaining an unfunded liability settled only at termination, DEWS introduces a structured, professionally governed savings framework that aligns more closely with international employment standards and evolving workforce expectations.

For employers, this shift supports stronger financial planning, improved risk management and a more sustainable approach to long term employee obligations. For employees, it provides transparency, portability and greater confidence in the security and growth of their End of Service benefits.

As organisations across the UAE reassess their reward and retention strategies, the DEWS model offers a practical and forward looking alternative to the traditional gratuity model.

For further information on DEWS, please contact Chris Cain at Equiom, the appointed Operator of the DEWS Plan.

Equiom Fiduciary Services (Middle East) Limited is regulated by the DFSA. Any information contained herein is intended only for Professional Clients or Market Counterparties as defined by the DFSA, and no other Person should act upon it. Equiom Fiduciary Services (Middle East) Limited only deals with Professional and Market Counterparty Clients and does not hold a Retail endorsement. However, all employers and employees participating in the DEWS plan will be treated as Retail Clients under the DFSA requirements. This material is provided for general information purposes only and does not constitute financial, investment, or legal advice. Any underlying investment options made available within an EOS arrangement could potentially carry investment and market risk, whereby the value of the underlying investments can go down as well as up. The underlying assets within some investment options may be illiquid and or subject to restrictions on their resale. Participants in any solution should undertake their own due diligence and where necessary seek independent professional advice on the available investment options. For further information on the regulatory status of our companies, please visit www.equiomgroup.com/regulatory