Structuring luxury assets: A Fiduciary services perspective from the Crown Dependencies

Ultra-high-net-worth individuals (UHNWIs) and their advisers are increasingly diversifying beyond traditional investments into luxury assets.

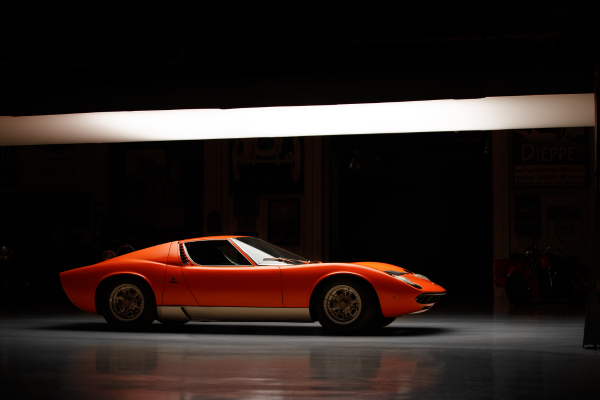

From supercars and fine art to rare whiskies, vintage wines, and high-value jewellery, these assets represent more than taste and prestige, they can also deliver long-term value and act as part of a broader wealth preservation strategy.

Yet, unlike equities or real estate, luxury assets come with unique risks. Without careful luxury asset structuring, ownership, succession, and protection can become complicated, leaving families exposed to disputes, tax inefficiencies, or even the loss of irreplaceable collections.

This is where a trusted fiduciary services provider plays a vital role.

Why luxury asset structuring matters

Luxury assets are often mobile, illiquid, and highly personal. Without a clear structure, they can be vulnerable to:

- Inadequate succession planning, leading to disputes among heirs

- Jurisdictional tax or reporting issues when assets are held internationally

- Depreciation due to poor storage, maintenance, or insurance oversight

- Risks around confidentiality, particularly in high-profile collections

Through asset structuring within a trust, foundation, or corporate entity, families can align ownership with their estate and tax planning objectives while ensuring confidentiality and professional stewardship.

Fiduciary duty and stewardship of luxury assets

Managing luxury assets requires more than administration; it demands specialist fiduciary oversight. Trustees and directors must balance both the client’s wishes and the long-term value of the asset. Effective fiduciary management should include:

- Comprehensive insurance policies tailored to high-value collections

- Secure storage and preservation facilities, from bonded warehouses and climate-controlled vaults to specialist garages for classic cars

- Regular valuations by recognised experts

- Transparent governance aligned with estate and tax planning structures

This level of stewardship ensures that assets retain and often enhance their value across generations.

The Crown Dependencies: Trusted jurisdictions for asset structuring

The Isle of Man, Jersey, and Guernsey are globally recognised centres for fiduciary services. Their long-established regulatory frameworks, political stability, and reputation for professionalism make them ideal jurisdictions for structuring and managing luxury assets.

Families and their advisers turn to the Crown Dependencies for:

- Confidential, secure and well-regulated environments

- Access to world-class fiduciary expertise

- Flexible structuring options, including private trust companies, incorporated cell companies, and foundations

- A track record of supporting UHNW families with multi-jurisdictional asset portfolios

Why choose Equiom for Luxury Asset Structuring?

At Equiom, we have decades of experience supporting UHNW families with complex structuring requirements across both traditional and alternative assets. Our strength lies in our ability to blend fiduciary services with practical, real-world knowledge of luxury assets.

- We work alongside families and their advisers to design and implement solutions that cover:

- Luxury asset structuring for collections spanning supercars, art, wine, whisky, and jewellery

- Specialist insurance and preservation strategies

- Cross-border compliance, particularly where assets are held in multiple jurisdictions

- Director-led, relationship-driven service that ensures discretion and continuity

With offices across the Crown Dependencies and a global network of experts, Equiom provides both local insight and international reach. We understand that for our clients, luxury assets are more than investments, they are part of a legacy. Our role is to ensure those legacies are protected, preserved, and passed on with care.

Looking ahead

As luxury markets continue to grow and with global collectible asset values forecast to rise significantly over the next decade, the need for robust fiduciary oversight will only increase.

For UHNW families and their advisers, the right fiduciary services provider is not just an administrator but a partner in safeguarding long-term wealth.

Whether it’s structuring a rare Ferrari collection, ensuring the secure transfer of fine art, or protecting the value of vintage wines and rare whiskies, Equiom combines technical rigour with personal service.

To discuss how we can support your luxury asset structuring needs, please contact our team.

This article has been carefully prepared, but it has been written in general terms and should be seen as broad guidance only. This article cannot be relied upon to cover specific situations and you should not act, or refrain from acting, upon the information contained within this article without obtaining specific professional advice. Please contact Equiom Group to discuss these matters in the context of your particular circumstance. Equiom Group, its partners, employees, and agents do not accept or assume any liability or duty of care for any loss arising from any action taken or not taken by anyone in reliance on the information in this article or for any decision based on it.