FSRA Consultation Paper No. 1 of 2025 – Proposal for Periodic Fund Reporting Requirements in ADGM

The Financial Services Regulatory Authority (FSRA) has released a consultation paper proposing a new Periodic Fund Reporting Requirement in ADGM. Below is a clear breakdown of the changes proposed to ADGM’s fund reporting requirements, why it matters, and how you can contribute your feedback.

What is the FSRA proposing?

The FSRA intends to introduce a Periodic Fund Return in ADGM that all Authorised Fund Managers (AFMs) must submit for each Domestic or Foreign Fund they manage. By making the Periodic Fund Return an integral part of ADGM’s fund reporting requirements, the initiative aims to enhance regulatory supervision, support a risk-based monitoring approach and align with international standards.

Why this matters for ADGM’s Fund Reporting Requirements

Currently, the FSRA receives limited post-launch data on funds – often fragmented and challenging to utilise. With this proposal, the FSRA aims to collect structured data on a regular basis to:

• Track trends and emerging risks

• Detect issues such as excessive leverage or liquidity problems

• Strengthen ADGM’s credibility as a leading fund jurisdiction

Who should read this FSRA Consultation Paper?

• Fund managers operating or planning to operate in ADGM

• Legal, compliance, and operations professionals in the funds industry

• Fund administrators and advisors

The deadline to submit feedback is on 29 April 2025. Send your comments to fsra.consultation@adgm.com, and please include “FSRA Consultation Paper No. 1 of 2025” in the subject line.

What is being proposed in the FSRA Consultation Paper?

A New Regulatory Return – the Periodic Fund Return in ADGM

- To be submitted for each Domestic Fund and Foreign Fund managed by an AFM

- Late filings will incur a late filing fee.

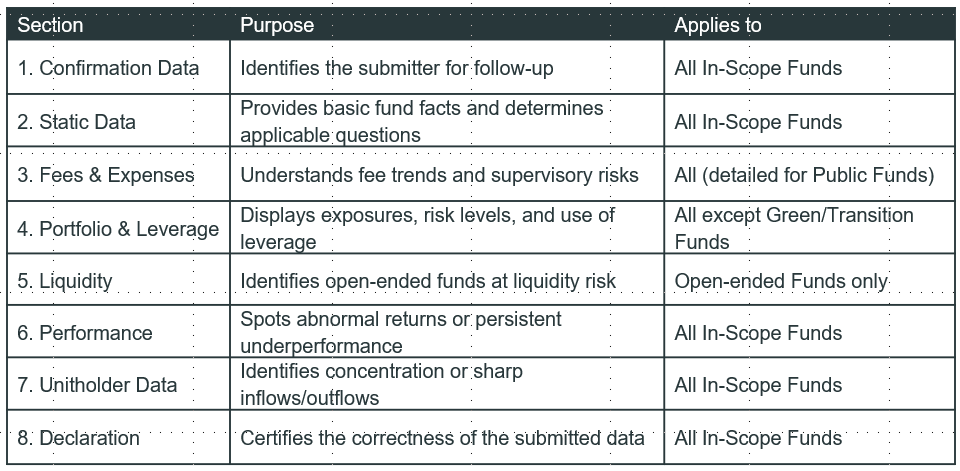

What will the Periodic Fund Return in ADGM Include?

ADGM’s Periodic Fund Return is structured into sections, each with a clear regulatory purpose:

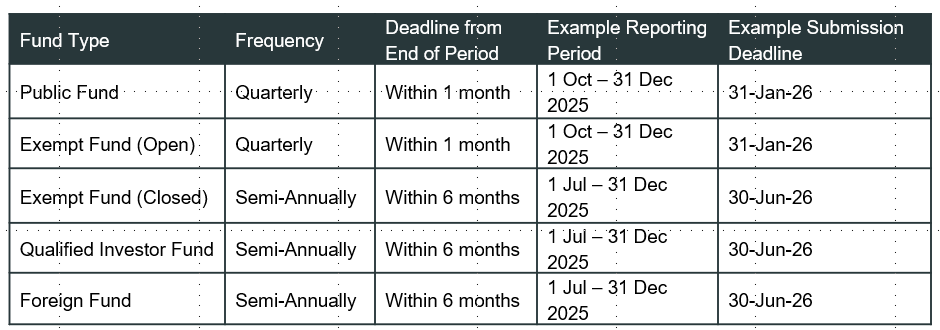

Reporting frequency and deadlines for the Periodic Fund Return in ADGM

- First reporting period for the Periodic Fund Return ends on 31 December 2025

- First Periodic Fund Return due date will either fall on 31 January 2026 or 30 June 2026, depending on the fund type

Our responses to the FSRA’s Consultation Paper questions on the ADGM Periodic Fund Return.

Q1: Should there be a periodic reporting requirement for funds?

Yes. It enhances transparency, supports supervisory oversight, and aligns ADGM with global best practices.

Q2: Is the proposed scope of information appropriate?

Generally, yes. However, consideration should be given to proportionality, as simpler or smaller funds may not need to report every detail.

Q3: Should reporting on portfolio holdings differ between Public Funds and other funds?

Yes. Public Funds – which are exposed to retail investors – should disclose more detail, while Exempt or QIF funds could report in summary form.

Q4: Should Gross Notional Exposure (GNE) be required for all funds?

Mostly yes, though it may be prudent to exempt smaller or unleveraged funds to avoid unnecessary burdens.

Q5: Are there challenges in gathering the information?

Yes – particularly for:

• Smaller managers

• Funds using multiple service providers

Clear guidance and standardised templates will be crucial.

Q6: What guidance would help?

• Examples of completed templates

• Clarification on leverage calculations

• A glossary of terms

• Guidance for umbrella or feeder structures

Q7: Do you agree with the assurance requirement for Public Funds?

Yes. Independent assurance – provided via a custodian or oversight committee – strengthens accountability and aligns with best practice.

Q8: Thoughts on the reporting periods and timeline?

The timeline is fair and gives funds sufficient time to prepare. The quarterly versus semi-annual split is appropriate, considering liquidity risk and investor type.

Q9: Preferred format for submission?

A web-based portal is preferred. Alternatively, a standardised Excel template with validation fields can be used. It is important to avoid free-text fields to ensure data consistency and usability.

Q10: Any other comments?

Consider introducing a pilot phase prior to mandatory reporting, provide a de minimis threshold for simpler funds, and coordinate with administrators to streamline data sourcing.

Feedback on the current funds framework

Q11: Are there any areas that need clarification?

Yes. For instance, rules regarding fund liquidation or wind-down reporting and the responsibilities when administration is outsourced require clearer identification, particularly concerning the onboarding process.

Q12: What suggestions do you have for updating the framework?

• Introduce clear rules on ESG or green fund disclosures

• Provide more clarity on tokenised or digital funds

• Consider simplified processes for launching feeder funds

Final Thoughts

The FSRA consultation paper No.1 of 2025 marks an important evolution in ADGM’s regulatory ecosystem. The aim to collect structured, risk-relevant data rather than relying on ad hoc updates is both practical and necessary. If executed well, this proposal will enhance ADGM’s fund reporting requirements by:

• Strengthening ADGM’s reputation

• Promoting transparency

• Keeping pace with global regulatory trends

If you’d like to discuss how this may impact your fund operations or reporting processes, our team is here to help.

Disclaimer: This article has been carefully prepared, but it has been written in general terms and should be seen as broad guidance only. This article cannot be relied upon to cover specific situations, and you should not act, or refrain from acting, upon the information contained within this article without obtaining specific professional advice. Please contact Equiom to discuss these matters in the context of your particular circumstance. Equiom Group, its partners, employees, and agents do not accept or assume any liability or duty of care for any loss arising from any action taken or not taken by anyone in reliance on the information in this article or for any decision based on it.